Let’s be honest. Trading in high-volatility niche markets—think obscure altcoins, micro-cap biotech stocks, or even collectibles futures—feels a lot like navigating whitewater rapids in a kayak. It’s thrilling, sure. The potential for rapid gains is what draws most folks in. But without a solid plan, you’re one wrong move from capsizing.

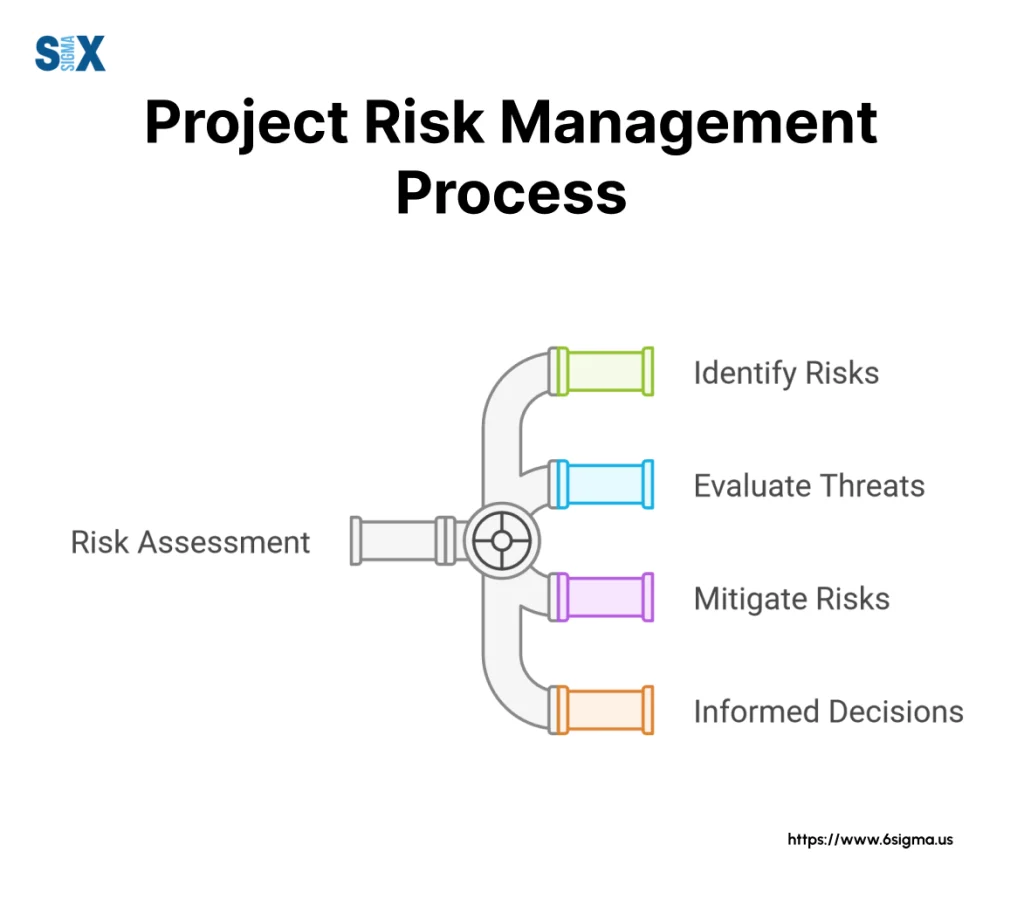

That’s where a proper risk management framework comes in. It’s not about avoiding risk; that’s impossible here. It’s about structuring your approach so you can survive the downdrafts and live to trade another day. Here’s the deal: we’re going to build a practical, no-fluff framework you can actually use.

Why Generic Risk Rules Fail in Niche Markets

You’ve probably heard the old adage: “Never risk more than 2% of your capital on a single trade.” It’s a decent starting point. But in a market that can gap 20% overnight on a random tweet? It’s like bringing a butter knife to a sword fight. The liquidity just isn’t there. Slippage can be brutal. News hits harder and faster.

Your framework needs to be adaptive. It must account for the unique chaos of your chosen niche. That means adjusting not just your position size, but your entire mindset.

Core Pillars of a Niche-Market Risk Framework

1. The Position Sizing Paradox

This is your first and most crucial defense. In high-volatility environments, you must size smaller than your gut tells you. A useful twist on the classic percentage rule is the volatility-adjusted position size. Here’s a simple way to think about it:

- Measure the Average True Range (ATR) or a similar volatility gauge for your asset over the past 14 days.

- Determine the dollar amount you’re willing to lose if the trade hits your stop-loss.

- Now, set your stop-loss based on volatility, not an arbitrary price point. A stop set at 2x the ATR below your entry is much more likely to survive normal noise than one set at a tight 5%.

- Back into your position size from there. If the volatility is wider, your position must be smaller to keep the potential loss constant.

2. The Three-Layered Stop-Loss System

Relying on a single stop-loss is a recipe for disaster. You need a layered approach—a safety net, if you will.

| Layer | Function | Mindset |

| Hard Stop (Technical) | Placed on exchange. Defines your maximum capital risk. Based on a key technical level breaking. | “My thesis is now invalid.” This is your circuit breaker. |

| Mental Stop (Time-Based) | Not placed on exchange. If the trade goes nowhere or sags for X days in this fast market, you’re out. | “This trade is dead money.” Frees up capital for better opportunities. |

| Catastrophic Stop (Market-Based) | A wider, emergency stop for black swan events or exchange issues. | “Something is systemically wrong. Preserve what’s left.” |

3. Portfolio Concentration & Correlated Chaos

Here’s a common mistake: a trader thinks they’re diversified because they own five different obscure altcoins. But when Bitcoin sneezes, they all catch pneumonia. That’s correlation risk.

Your framework must limit exposure to a single niche (say, no more than 30% of your risk capital) and, crucially, to highly correlated assets within that niche. It feels counterintuitive—you’re an expert in this one area!—but it’s the only way to avoid being wiped out by a single sector-specific catastrophe.

Psychological Frameworks: Managing Yourself

All the math in the world won’t save you from yourself. In volatile niches, FOMO and panic are amplified. You need mental rules.

The 24-Hour Rule: Before entering any position above your normal size, impose a 24-hour cooling-off period. The hype will often fade.

The Profit-Taking Protocol: Decide in advance how you’ll take profits. Will you scale out? Take initial risk off the table once you’re up 2:1? Having a plan prevents you from turning a 100% gain into a 50% loss because you got greedy. And you will get greedy.

Honestly, the emotional rollercoaster is the real market. The charts just reflect it.

Operational Risks: The Overlooked Killers

We focus on market risk, but what about the other stuff? In niche markets, operational risks are huge.

- Liquidity Risk: Can you actually get out at your price? Always check order book depth.

- Platform Risk: Is your niche broker or crypto exchange reliable? What’s their history during crashes?

- Information Risk: Niche markets are ripe for pumps, rumors, and scams. Verify, then verify again. Consider the source of your “alpha.”

Building a checklist for these operational factors before hitting “buy” is a non-negotiable part of your framework. It’s boring. It saves your account.

Putting It All Together: A Sample Daily Checklist

So what does this look like in practice? It’s a rhythm. A habit.

- Pre-Market: Check overall market sentiment. Any macro landmines? Review your open positions against your layered stops.

- Trade Entry: Calculate volatility-adjusted position size. Set hard stop. Note mental stop condition. Check portfolio correlation.

- Trade Management: If profit target 1 is hit, move stop to breakeven. Breathe.

- Post-Market/Weekly: Review all trades. Journal the psychological triggers you felt. Adjust your framework if you see a repeating error—not a losing trade, but a process error.

This isn’t about perfection. It’s about consistency. You’re building a system that works when you’re too emotional to think straight.

The Ultimate Goal: Asymmetry

At the end of the day, a robust risk management framework for high-volatility niches seeks one thing: asymmetric upside. You’re structuring your trades so that your potential losses are limited, understood, and controlled, while your potential gains—though never guaranteed—are allowed to run within the wild momentum of your chosen market.

It turns the chaos from an enemy into a landscape. You stop being a leaf in the wind and start being the navigator, map in hand, knowing some paths lead to cliffs and others to undiscovered territory. The volatility isn’t your risk; the lack of a plan is.