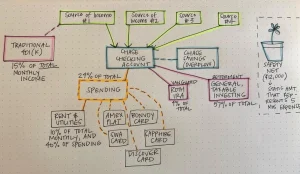

A loan on credit card is an unsecured loan given to a credit card holder for various purposes. The loan amount depends on the amount you have spent, your transaction pattern and repayment history. These loans can be obtained instantly and are disbursed quickly. They are ideal for paying off outstanding credit card debts. It is very important to make timely payments to avoid late fees and high interest rates.

A loan on credit card is best for emergency situations. This type of loan is typically pre-approved, and you can get the money right away. You must have a sufficient credit limit on your card to qualify for the loan, or else you might be refused. However, the interest rate is higher than for a personal loan.

Another benefit to a loan on credit card is that it will help you build credit history. A credit card loan is available to select cardholders who have a good credit history and a commendable repayment history. In addition, your income level will likely have a positive impact on your eligibility. As a result, it is important to compare interest rates on multiple types of loans and make sure you choose one with flexible payment schedules and features that improve your credit.

Another benefit of a loan on credit card is the ease of repayment. Many banks offer convenient repayment options that include EMIs directly on your credit card statement. Many banks will also offer multiple tenures for you to choose from. This means that you can get the money you need and repay it in as little as 60 months.

Another benefit to a loan on credit card is that the amount you can borrow is entirely dependent on your credit limit. You can always negotiate with your bank for a higher loan amount if your credit score is good. In some cases, you may even be able to negotiate with your creditor and get a lower interest rate.

A credit card loan is a great alternative to cash withdrawals. It works well if your credit card cash limit is too low and you need more money. In addition, credit card loans attract lower interest rates than cash withdrawals. In addition, you can get disbursed money very quickly and without having to provide any documents. This loan can be issued to either new or existing customers.

Another benefit of a credit card loan is that you can borrow up to 75% of your credit limit, with the remaining 25% subject to the prevalent credit card interest rate. Moreover, if you fail to pay the loan within the interest-free period, you may be charged up to 35% interest. Moreover, you can always opt for pre-closing your loan. Depending on your credit card’s limit, you can choose to pay your loan over 6 months, a year, or five years.