A loan account statement is a document that outlines your account transactions. It will show both debit and credit entries along with reference details. In addition, you can filter your statement based on certain criteria, such as date range and type of transactions. You can also save the activities on the page to a PDF file.

Using a template, you can generate your monthly loan account statement. This document will also show daily interest calculations. The template was designed for home loans, but it can be applied to any monthly repayment or daily interest loan. You will have to make sure to fill in the correct interest rate for your account. Otherwise, the loan account statement may not be accurate.

The statement contains a Summary sheet and a Statement sheet. The Summary sheet is used to analyze loan account transactions and review your loan account balance history. It also includes conditional formatting, which highlights cells with nil amounts. To create a summary sheet, you should create a table in Excel with the desired number of rows and columns and add the appropriate number of monthly periods.

The statement is sent to you once per month, and you can access it online under Payment History, Statements, and Download. It will include your monthly payment, the amount you owe, the interest rate, and the due date. The statement will include information on the loan’s title and personal information. It will also list the loan number, which is like an account ID number.

The Statement sheet also shows details about ad-hoc repayments. If you make an ad-hoc repayment, you can record the amount as a negative amount on the Statement sheet. In this case, the transaction will be highlighted in orange until you make the correction. Similarly, if you make a scheduled loan repayment, you will also need to enter the ad-hoc repayment amount.

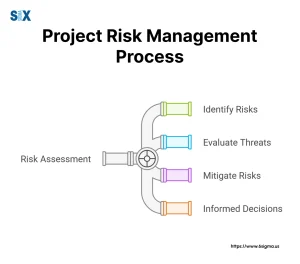

The loan account statement can help you plan your finances better. It shows details about how much money you owe and how many EMIs you’ve made. It also tells you how much money you have left on the loan. If you miss a payment, you can be charged a penalty. To avoid penalties, make sure to keep an eye on the statement to make an informed decision.

The account statement is an essential tool in budgeting. In addition to your loan’s outstanding balance, it can include fees and interest rates. Also, it will show whether or not you’ve missed a payment or overspent. You’ll want to know what fees you owe so that you can make appropriate payments. You can also review your account statement online to get an overview of your accounts and their payment history.

The loan account statement is an essential tool for keeping track of your loan payments. If you have missed a payment, you can get your statement from the bank through the online portal. You can print a copy of your statement or save it to a PDF. You’ll need your PAN card and Aadhar card to access your statement online.